German ecological and civils rights team Urgewald has actually revealed just how significant banks remain to money the metallurgical coal sector, channeling virtually $52 billion right into mine growths in between 2022 and 2024 regardless of worldwide environment dedications.

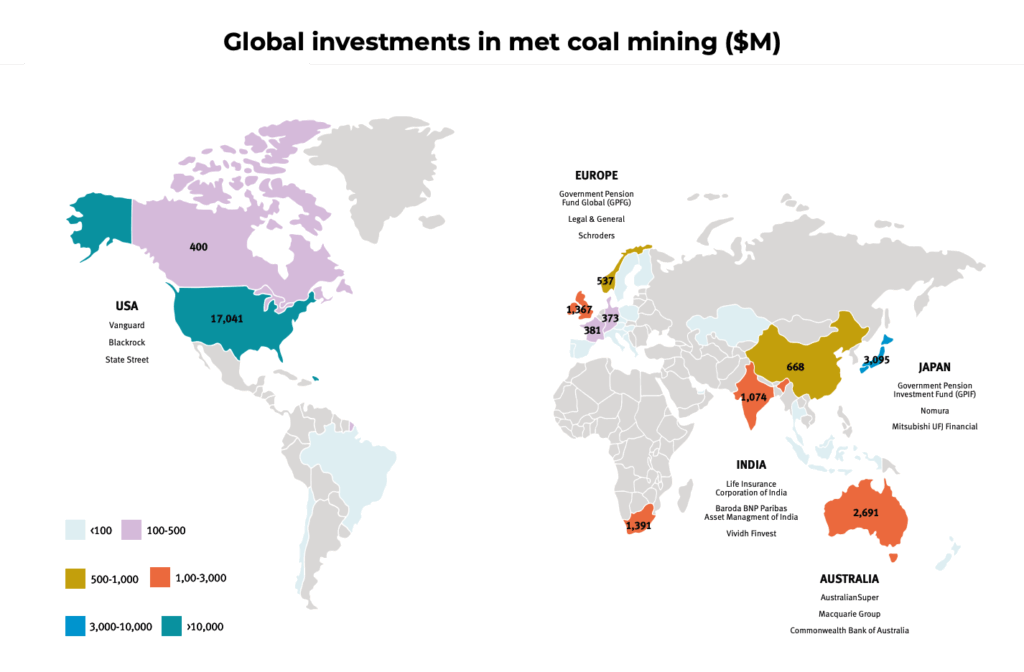

Its brand-new record, Still Burning: How Banks and Investors Fuel Met Coal Expansion, exposes that financial institutions gave $22 billion in finances and underwriting throughout the duration, while institutional capitalists hold $30.23 billion in safety and securities linked to business increasing coal mining procedures. The leading capitalists consist of Lead, BlackRock, and State Road.

Urgewald, which previously this year introduced the first global database of metallurgical coal developers, claims several sponsors have actually promised to finish coal financing yet omit metallurgical coal from those assurances, which the state it’s a “unsafe” technicality to environment objectives. Met coal make up around 11% of worldwide carbon monoxide two exhausts.

” Met coal gas the environment dilemma all the same as thermal coal,” Lia Wagner, satisfied coal professional at Urgewald, claims. “Financial institutions and capitalists that neglect this truth are funding the damage of our earth’s carbon spending plan.”

Steelmakers depend on metallurgical or coking coal to give the carbon and warm required to transform iron ore right into liquified iron in blast heaters. While electric-arc heaters are progressing, they have to depend on scrap steel which implies they can not change coking coal at commercial range. Green-hydrogen techniques can function, yet they require plentiful economical eco-friendly power and massive hydrogen manufacturing, which are not yet commonly offered.

Up until those options develop, experts alert that satisfied coal will certainly remain important to constructing the wind generators, transmission lines and electrical cars (EVs) driving the power shift itself.

China, United States lead funding

The record recognizes 201 financial institutions that funded metallurgical coal designers in the last few years, with Chinese establishments controling at 67% of worldwide financing– approximately $14.7 billion. China Everbright, CITIC, and CSC Financial cover the checklist, driven by need from China’s substantial blast-furnace steel sector.

The USA rates 2nd, adding $3.04 billion. Jefferies Financial Team leads united state sponsors, enhancing its satisfied coal financing virtually 400% considering that 2022. In 2024, Jefferies, together with KKR Team and Deutsche Financial institution, prepared a $2 billion lending to Peabody Power, which later on deserted a significant purchase adhering to mine fires in Queensland, Australia.

” Also as the marketplace signals decrease, United States sponsors are holding on to fulfill coal,” Wagner stated. “None of this has to do with shielding steelworkers– it has to do with collaring temporary earnings.”

Europe’s “dual requirement“

European financial institutions, regardless of their environment unsupported claims, funnelled $1.54 billion right into satisfied coal designers over the previous 3 years. Deutsche Financial Institution, BNP Paribas, Santander, and Credit History Agricole are amongst the leading sponsors, a number of which had actually promised to quit backing brand-new coal tasks.

Much of this financing mosted likely to Glencore, whose mountaintop-removal mines in British Columbia have contaminated rivers and damaged environments. Both Deutsche Financial institution and UBS formerly pledged not to fund such procedures yet remain to sustain Glencore.

” It’s sanctimonious for European financial institutions to extol thermal coal phase-outs while covertly moneying satisfied coal mining,” Cynthia Rocamora of Reclaim Financing, stated.

” It’s sanctimonious for European financial institutions to extol thermal coal phase-outs while covertly moneying satisfied coal mining,” claims Cynthia Rocamora from Reclaim Financing.

Japan and Australia were likewise located to maintain coal’s lifeline. Over the coverage duration, Japanese financial institutions spent $1.22 billion in metallurgical coal designers, led by Mitsubishi UFJ, Mizuho, and SMBC Team. Japan’s steel titans, Mitsubishi Firm and Nippon Steel, are increasing coal mines in Australia also as they advertise “eco-friendly improvement” projects.

Australia’s financial institutions and capitalists included an additional $644 million, with Petra Funding and ANZ blazing a trail. Their funding has actually aided business like Stanmore Resources and BHP expand coal mining well right into the following century.

” ANZ’s coal plan is not appropriate in the middle of an environment dilemma,” Adam Currie of 350 Aotearoa claims. “Its plans consist of very carefully crafted technicalities that remain to allow the development of metallurgical coal.”

Coal’s future

While financial institutions maintain the finances streaming, capitalists are making sure coal’s durability. Since July 2025, institutional capitalists hold $30.23 billion in safety and securities linked to business increasing metallurgical coal procedures, with united state capitalists controling at $17.04 billion.

The globe’s leading 5 capitalists are Lead ($ 3.33 billion), BlackRock ($ 3.05 billion), State Road ($ 1.97 billion), Berkshire Hathaway ($ 797 million), and Japan’s Federal government Pension plan Mutual fund ($ 733 million). Jointly, they regulate virtually one-third of worldwide satisfied coal financial investments.

Regardless of its “sustainability-conscious” method, Japan’s GPIF has actually attracted objection for holdings in Mitsubishi, Glencore, and Coal India. At the same time, Australia’s biggest pension plan fund, AustralianSuper, has actually increased its risk in Whitehaven Coal to 8.47%. Whitehaven’s Blackwater South and Winchester South tasks endanger hundreds of hectares of koala environment.

Urgewald’s record wraps up that proceeded satisfied coal funding is inappropriate with the 1.5 ° C environment target. With the EU’s Carbon Border Adjustment Mechanism working and eco-friendly hydrogen steelmaking obtaining grip, the period of coal-based steelmaking, it advises, is nearing its end.

” The moment for reasons mores than,” Wagner claims. “Banks have to shut the metallurgical coal technicality finally because, basically, coal is coal.”

发布者:Cecilia Jamasmie,转转请注明出处:https://robotalks.cn/banks-investors-pumped-52b-into-met-coal-between-2022-and-2024-report-2/