Thirteen Chilean copper jobs worth $14.8 billion are anticipated to strike vital landmarks in 2026 as costs increase on worries of an international supply press.

Chile stands to profit as 7 residential jobs intend to begin procedures following year, including nearly 500,000 tonnes of yearly ability backed by $7.1 billion in financial investment, according to main numbers.

The checklist consists of Anglo American/Glencore’s Collahuasi framework and efficiency upgrades, called project C20+, Codelco’s Rajo Inca structural project, Capstone Copper’s Mantos Blancos and Andes Iron’s debated Dominga.

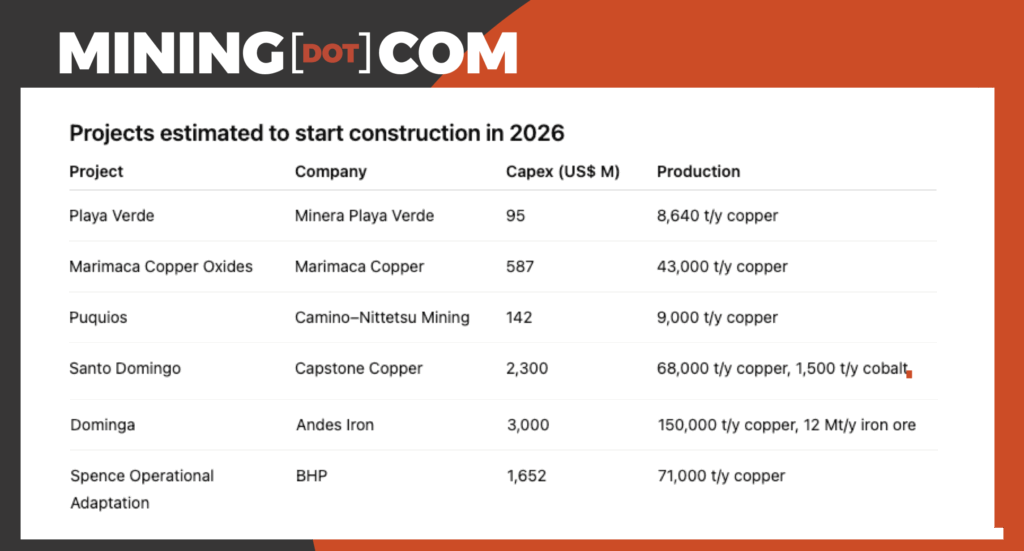

One more 6 growths prepare to start building and construction, standing for $7.7 billion in investing linked to copper’s critical function in power and modern technology. Those consist of BHP’s Spence and Capstone’s Santo Domingo.

Juan Ignacio Guzmán, chief executive officer of Chilean mining working as a consultant treasure, claimed that while numerous jobs are set up to start generating in 2026, they will not attain complete ramp-up instantly. Based upon estimates from the Chilean copper commission (Cochilco) Guzmán kept in mind the pipe can raise Chile’s result to around 5.6 million tonnes, or about an added 100,000 tonnes of great copper within a year.

The expert claimed the International Copper Study hall sees a 2026 deficiency of 150,000 tonnes, a space that would certainly broaden if Chilean jobs delay.

” The lasting fact is that developing a brand-new mine is hard. Virtually every little thing the worldwide economic situation intends to purchase is copper-intensive, consisting of the power shift and AI,” Standard Minerals copper expert Albert Mackenzie claimed.

Guzmán claimed the primary danger for Chile’s 2026 slate exists with neighborhood relationships as opposed to market characteristics or the brand-new federal government taking workplace in March 2026.

” The function of neighborhoods will certainly remain to matter,” he claimed. While jobs beginning procedures have actually currently removed vital obstacles, he advised that those readied to start building and construction face recurring authorization procedures that can wind up in court.

The specialist likewise highlights that considerable financial investment is necessary for these forecasts to emerge. State-run Cochilco anticipates the nation to draw in $105 billion from this year via 2034. The company keeps in mind the quote consists of growths at combined procedures such as BHP’s (ASX: BHP) Escondida, the globe’s biggest copper mine.

Katz variable

The current triumph of ultra-conservative previous congressman José Antonio Kast, that is readied to take workplace as Chile’s following head of state in March, is being watched by markets as favorable. Kast’s win stands for a change towards an extra pro-investment, pro-development position in Chile, mining investors said.

His management is anticipated to simplify allowing and ecological authorizations, lower regulative unpredictability and deal better financial security, decreasing the danger of brand-new tax obligation or nobility modifications mid-cycle.

Kast’s law-and-order strategy can likewise bring better functional assurance by suppressing demonstrations and disturbances that have actually postponed mining task in recent times, though it might increase stress with some neighborhood neighborhoods, market experts kept in mind.

For Chile’s 13 copper jobs, a few of which are nearing manufacturing, this can convert right into faster decision-making, less complicated accessibility to personal and international funding, and a greater chance of relocating from preparing to implementation in time to catch a favorable 2026 copper market.

Document highs

Copper has actually climbed up virtually 40% this year, striking a document $11,800.5 a tonne on Dec.11 as supply issues grow. Stocking in the United States has actually included stress, with firms speeding up cathode deliveries right into American storage facilities in advance of feasible 2027 tolls on polished copper.

Mackenzie claimed the United States has actually driven the 2025 rate run-up, with an approximated 730,000 to 830,000 tonnes drawn away right into residential storage space and leveraged versus the CME futures contour. The change has actually tightened up LME supplies, increased costs in Europe and Asia, and improved costs for CME-deliverable brand names such as Codelco cathodes.

Check live copper prices

Belief likewise enhanced after Chinese smelters revealed a 10% result cut for following year. JP Morgan anticipates a 2026 improved copper deficiency of 330,000 tonnes. Mackenzie claimed mining ability will certainly be limited since no significant brand-new growths are coming on-line and numerous procedures are underperforming. Also when brand-new mines open, he claimed, steel requires time to get to the marketplace.

” When Freeport’s Grasberg mine had its interruption, costs leapt instantly,” he claimed. “Investors really did not claim, ‘allow’s wait 3 months for it to matter.'”

The marketplace “discovers a method“

Mackenzie rejected lasting architectural deficiency projections. “The marketplace constantly discovers a method,” he claimed. Greater costs can suppress need, even more scrap can go into the system and replacement can reduce stress. He recognized, however, that need will certainly increase and removal is obtaining harder.

Projects required to fulfill that need needs to currently be incomplete, and some customers are currently discovering options after years of favorable lack stories.

发布者:Dr.Durant,转转请注明出处:https://robotalks.cn/chile-loads-its-copper-cannon-with-13-projects-for-a-bullish-2026/